Execute Deals Anytime. Anywhere. Real-time.

One Legal Brain

Unified Neuro Intelligence

Neuro Intelligence advances AI into a single legal brain that reasons, adapts, and execute decisions in real time.

Unified Neuro Intelligence

(Unified Neuro Intelligence detects Fed Circular 2022.09.14 on Float Handling and updates draft logic accordingly, in real-time.)

NeuroCircle is built on a simple premise: law should execute, not obstruct.

Our proprietary unified Neuro Intelligence acts as a first of its kind sovereign legal brain that absorbs regulatory complexity, adapts to shifting mandates and triggers critical decisions in real time, all without human initiation.

A Maze of Regulators

(Neuro Intelligence reconciles federal conflicts, eliminating downstream legal delays. Net impact: clause turnaround time cut by 84%.)

Regulations, globally move fast and often conflicts. Without a unified approach, interpreting and complying with these directives can lead to delays and missteps. NeuroCircle turns this complexity into a seamless experience and triggers compliant deals in real time.

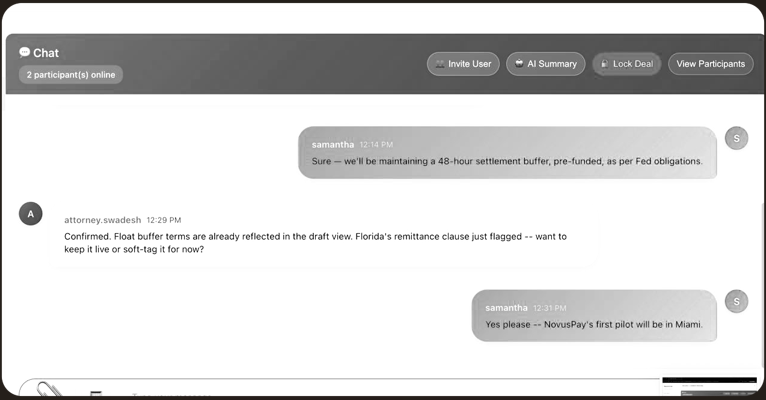

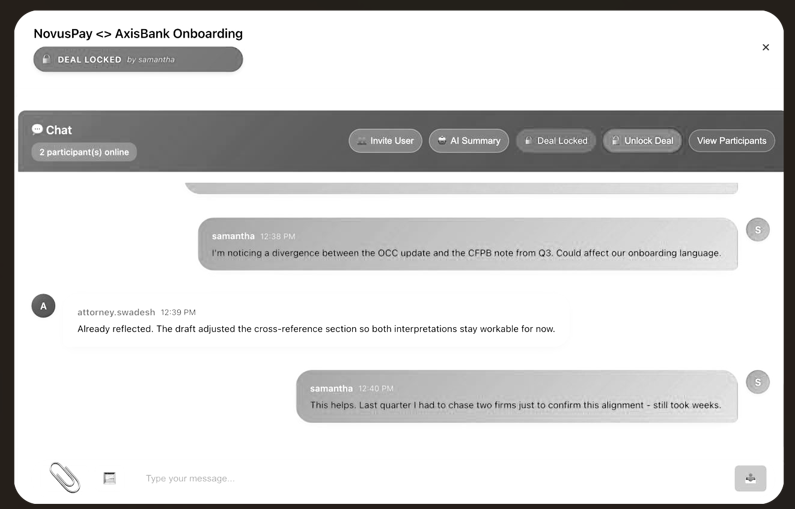

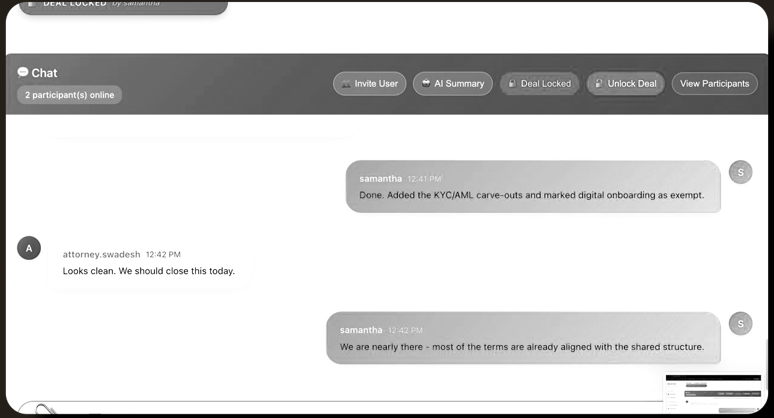

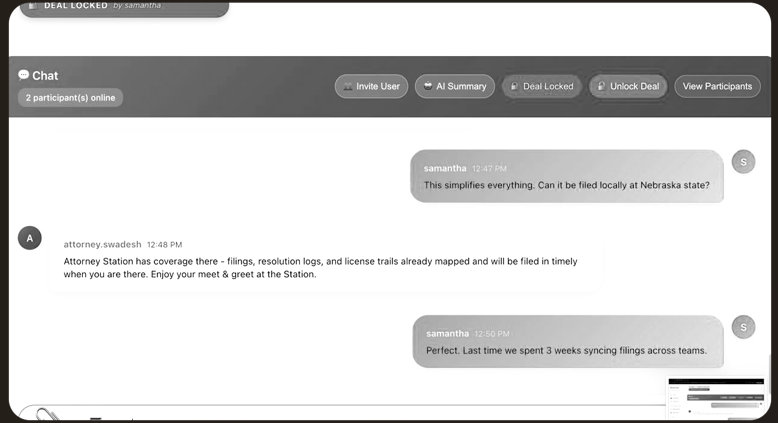

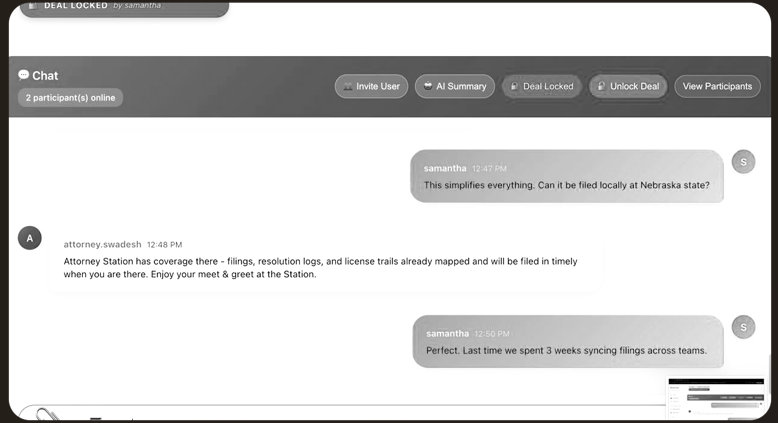

Fragmented Negotiations

(Corem instantly converts highlights into contractual language — no legal ping-pong.)

Deal execution today is slow and siloed—negotiations spread across endless emails, chats, and documents. This fragmentation causes misalignment, delays, and lost opportunities. NeuroCircle lets you execute deals in real time in its integrated deal room—Corem.

Access and Infrastructure Gap

Legal infrastructure, reimagined for the real world. Civil legal systems remain opaque, fragmented, and fundamentally unscalable. NeuroCircle brings Neuro AI into the physical world—delivering an operational layer that handles end-to-end legal operations without relying on law firms at every step. No backlog. No gatekeeping. Just action, at the speed of cognition.

Access and Infrastructure Gap

Legal infrastructure, reimagined for the real world. Civil legal systems remain opaque, fragmented, and fundamentally unscalable. NeuroCircle brings Neuro AI into the physical world—delivering an operational layer that handles end-to-end legal operations without relying on law firms at every step. No backlog. No gatekeeping. Just action, at the speed of cognition.

Why Us

“It is time to fight back … The biggest problem I have with all these overlapping rules is that we are not stepping back and saying, what could we do better to make the system work better.”

Jamie Dimon CEO, JPMorgan Chase

“The industry’s concerns that the 2010 Dodd‑Frank banking regulation law would make U.S. banks uncompetitive have been heard loud and clear … regulators should coordinate their approaches.”

Janet Yellen U.S. Secretary of the Treasury

“We should not come to a situation where regulation stymies innovation to a point that innovation happens elsewhere.”

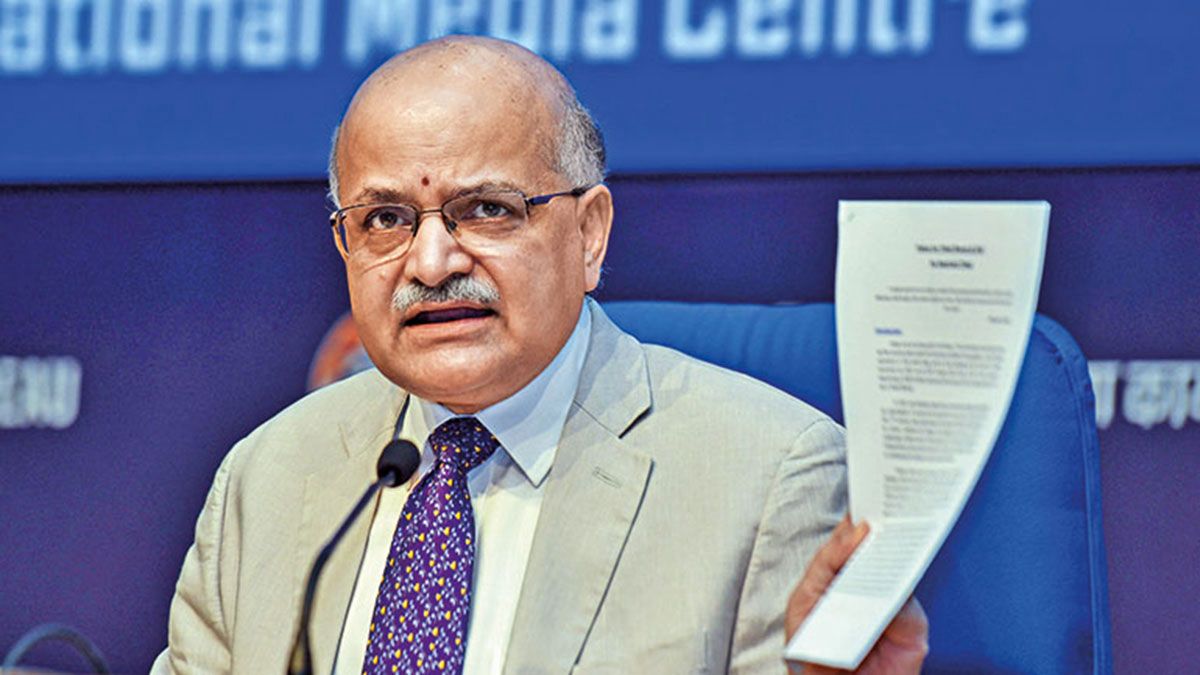

B. V. R. Subrahmanyam CEO of NITI Aayog

“There is no perfect regulatory approach. … We at the RBI are gradually shifting towards principle‑ and outcome‑based regulations, as it gives operational flexibility … while adhering to the regulatory framework for delivering the outcomes expected from them.”

M. Rajeshwar Rao, Deputy Governor, RBI

Who We Serve

Banks & Financial Institutions

Regulations move fast, but with Neuro Intelligence you no longer chase them. Our platform automates regulatory tracking and clause updates and includes stress‑simulation tools to anticipate shocks and maintain resilience. Focus on your customers while NeuroCircle let your bank move at deal-speed.

Payments & Fintech

Fast-growing fintechs and payment companies often face a paradox: scale quickly, yet stay compliant at every minor step of the way. NeuroCircle embeds its legal brain into product and operations, enabling you to launch, license, and expand — without navigating outdated legal rails. Build boldly. Execute Instantly.

Government & Regulators

Understand the entire ecosystem at a glance. Aggregated dashboards reveal patterns and outliers, and policy simulation tools let you test the impact of new rules. NeuroCircle enables policy translation and regulatory monitoring at the speed of cognition.

Our Platform

Mission: We believe legal should be demystified. Our mission is to build embodied Neuro Intelligence that understands law and the physical world.

Vision: To resolve legal friction where infrastructure is missing or delayed, by embedding intelligence directly into systems, not institutions.

“The U.S. regulatory framework has grown expansively to become overly complicated and redundant, with conflicting and overlapping requirements. This growth has imposed unnecessary and significant costs on banks and their customers.”

Michelle W. Bowman, Vice‑Chair for Supervision, Federal Reserve Board.